Contents

Notes: Weekly national average rates on conventional, conforming, 30- and 15-year fixed and 1-Year CMT-indexed adjustable rate mortgages, with loan-to-value (LTV) rates of 80 percent or less, 1992 – present, are available. The required fees and points are not included.. The search results are for illustrative purposes only.

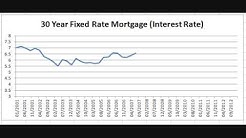

Historically, the 30-year mortgage rate reached upwards of 18.6% in 1981 and went as low as 3.3% in 2012. 30 Year Mortgage Rate is at 3.64%, compared to 3.73% last week and 4.65% last year. This is lower than the long term average of 8.02%.

Historically, the 30-year mortgage rate reached upwards of 18.6% in 1981 and went as low as 3.3% in 2012. 30 Year Mortgage Rate is at 3.64%, compared to 3.73% last week and 4.65% last year. This is lower than the long term average of 8.02%.

Mortgage Rates Historical Chart – If you are looking for an online mortgage refinance service, then we can help you. Find out how low your payments can go.

BlackRock Income Trust is a fund predominately invested in investment grade mortgage-backed securities. The fund just turned 25 in January (25 years!). The following chart shows the distribution.

2Nd Home Refinance Rates Get A Cash-Out Refinance On Your Second Home. Rates will be higher than getting a no-cash refinance. For instance, an applicant with a 720 credit score will pay about 1% of the loan amount in fees, compared to an applicant requesting a no-cash-out refi. This translates to about a 0.125% to 0.25% higher rate. So,

30-Year Fixed Rate Mortgage Average in the . Mortgage Rates Interest Rates Money, Banking, & Finance. Sources. More Releases from Freddie Mac. Releases. More Series from Primary Mortgage Market Survey. Tags.

Going Mortgage Rates Today mortgage rates improved again today, keeping the week-over-week move decidedly friendly. If you are seeing improved pricing today, i would recommend you go ahead and lock in the gains. Only loans i.

Mortgage rates rose on the expectation that the Fed will cut. realize that rates may rise and fall a little bit, but historically today's rates are very.

Talk about a toboggan ride. U.S. historical mortgage rates from the early 1970s to 2019 have been on a decidedly downward trend. The charts tell the story, painting a remarkable picture of the.

The following chart goes back to 2010 and highlights Black Friday’s role in the immediately surrounding trading environment. While those roles have varied somewhat, the common theme is that Black.

30 Year Fixed Mortage Rates A 30-year fixed-rate mortgage is the most common type of mortgage. However, some loans are issues for shorter terms, such as 10, 15, 20 or 25 years. Getting a loan with a shorter term can raise your monthly payment, but it can decrease the total amount you pay over the life of the loan.

View and compare urrent (updated today) 15 year fixed mortgage interest rates, home loan rates and other bank interest rates. Fixed and ARM, FHA, and VA rates.

Mortgage Lender Directory + Mortgage Calculators + Mortgage (ARM) Indexes: Mortgage Market Survey + Find The Best Mortgage + Ask A Mortgage Related Question + Articles And Publications + Mortgage Glossary + Search Mortgage Rates + Credit grade guide: historical mortgage index data + Historical Mortgage Rate Data + Home: Interest Rate Trends

Borrower’s Paradise It’s one of the best times in U.S. history to borrow money. The 30-year fixed-rate mortgage topped 18% back in the. the Fed is slowly turning off the cheap money tap. The new.